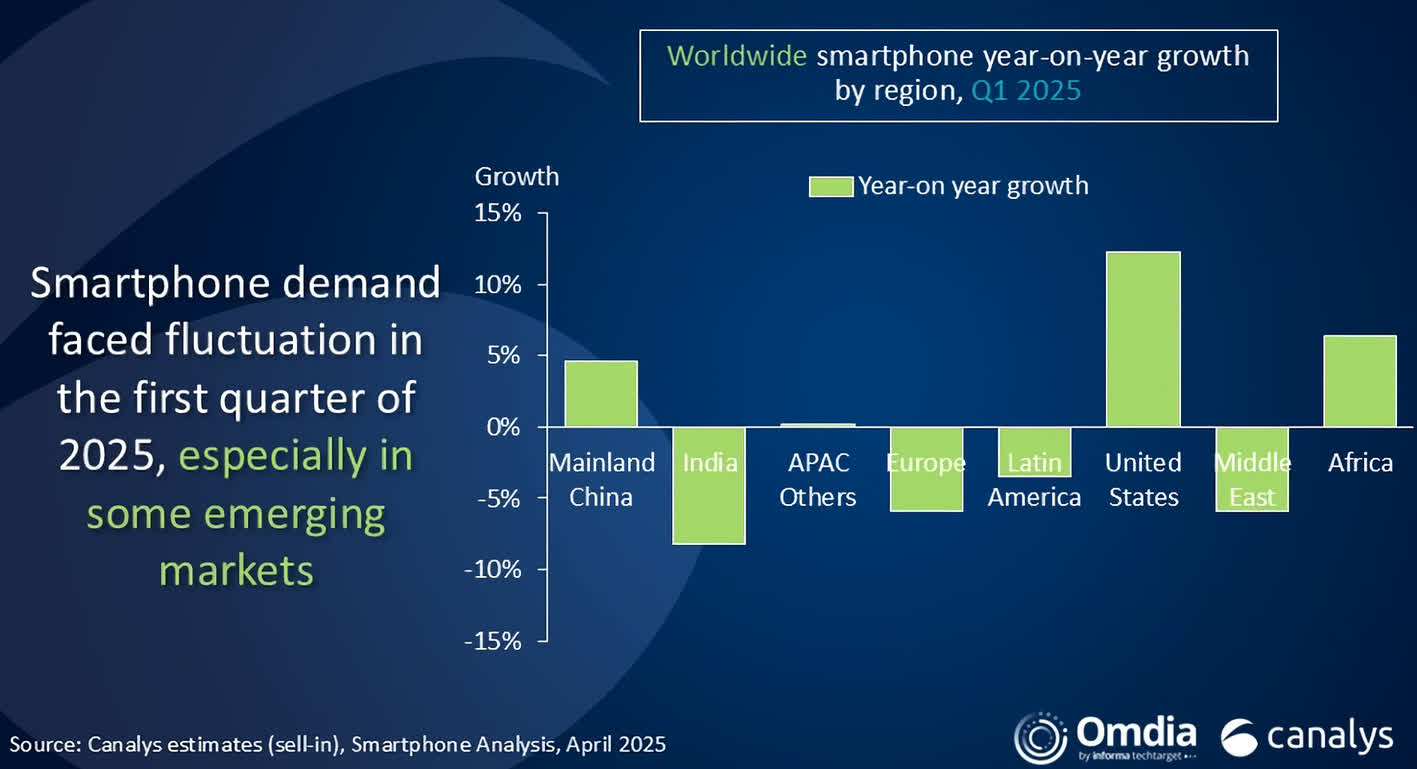

The big picture: The global smartphone market grew by just 0.2 percent in the first quarter of 2025. Shipments reached 296.9 million units during the first three months of the year and while growth is growth, Q1 2025 became the third consecutive quarter in which growth slowed.

Market research firm Canalys cited several reasons for the continued sluggishness in the smartphone industry. The most recent replacement cycle has come to an end and with uncertainty in the global economic landscape, several vendors are being more cognizant with regard to inventory levels.

Samsung narrowly edged out Apple for the number one spot with 60.5 million units shipped in Q1, good for a 20 percent market share but just one percent growth compared to the same period a year earlier. Apple shipped 55 million iPhones, capturing 19 percent of the market. Strong growth in the US and Asia Pacific markets helped Apple grow its market share by 13 percent year over year.

Xiaomi, Vivo, and Oppo rounded out the top five with shipments of 41.8 million, 22.9 million, and 22.7 million units, respectively. All others combined shipped 94 million units for a 32 percent share.

Canalys research manager Le Xuan highlighted strong growth in the US, which was primarily led by Apple. Cupertino was among the few that proactively built up inventory ahead of anticipated Trump tariffs, Xuan said, who further noted that the company also increased iPhone production in India to reduce its tariff risk.

Speaking of tariffs, Canalys expects them to disproportionately impact the cost of entry-level smartphones. In other words, the market for cheap smartphones will dry up as the average selling price increases.

We're already seeing signs of this with other electronics, and not just with entry-level devices. Microsoft recently surprised everyone with an unexpected Xbox price hike that sees the console go up $80 to $130 depending on the model. Games are also getting more expensive, with some upcoming premium titles now to set to retail for $80 apiece.

Image credit: Jonas Leupe