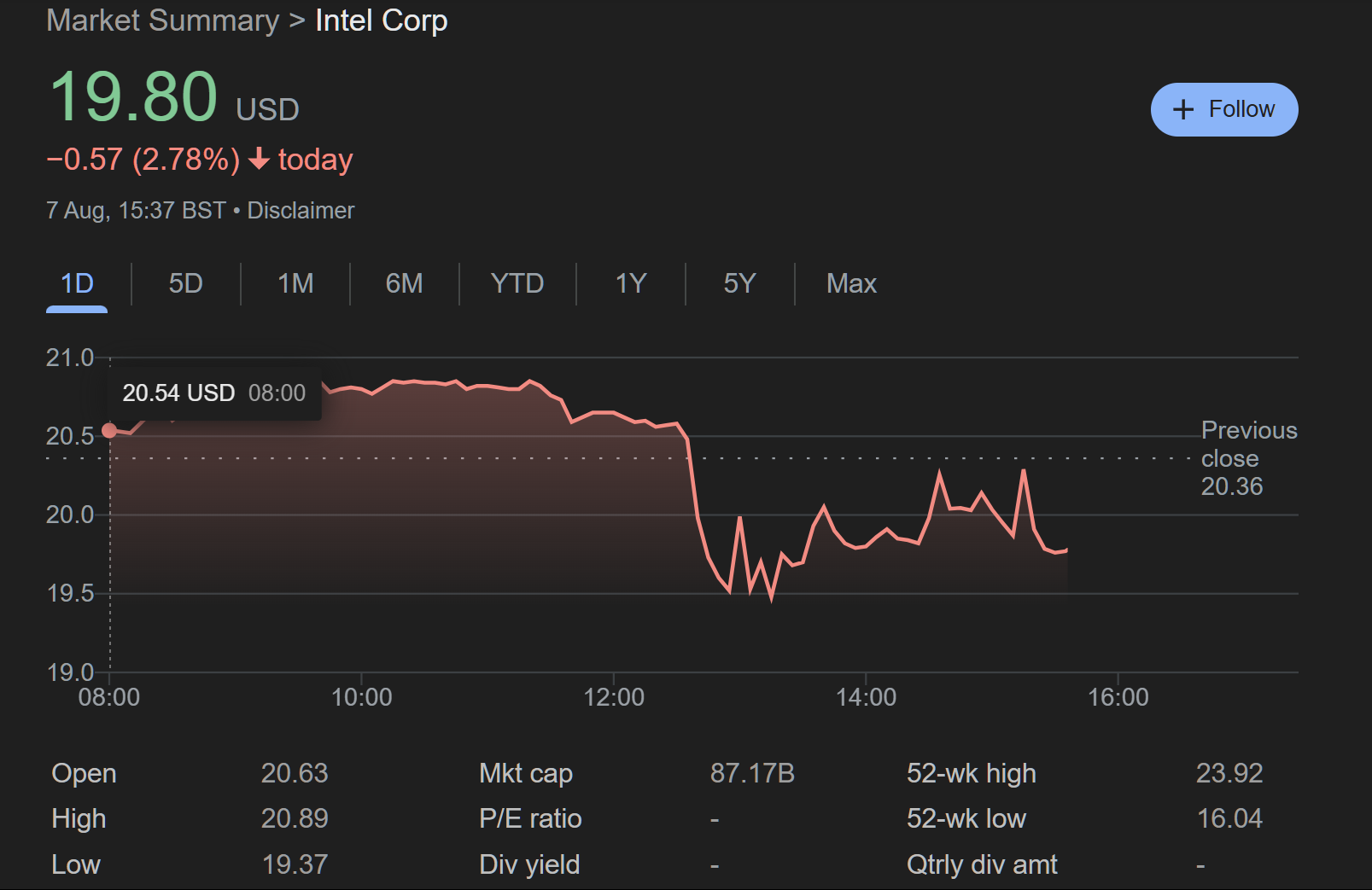

Will Intel ever catch a break? Following yesterday's report that a US Republican Senator has asked questions about CEO Lip-Bu Tan's ties to Chinese companies, President Trump has called on Tan to resign his position at Team Blue immediately. The post caused Intel's shares to fall 5% in premarket trading.

In a Truth Social post, Trump said that Tan is "highly CONFLICTED and must resign, immediately. There is no other solution to this problem."

Trump never said anything else in the post, but it's obviously a reference to the news that US Senator Tom Cotton had sent a letter to Intel's board of directors regarding Tan's ties to Chinese companies, asking whether he had been required to divest from chip firms linked to the Chinese military or Communist Party.

Tan has invested at least $200 million into Chinese advanced manufacturing and chip firms, mostly through his VC firm, Walden. It is not illegal for US citizens to hold stakes in Chinese entites, even when they have ties to the Chinese military, but not if they have been added to the US Treasury's Chinese Military-Industrial Complex Companies List. Reuters writes that there is no evidence that Tan has invested directly in any company on this list.

Sources say Tan has divested his positions in entities in China, though Reuters reports that many of his investments still appear as active in Chinese databases.

Cotton also asked Intel chairperson Frank Yeary if he was aware of the subpoenas sent to Cadence Design Systems during Tan's tenure as CEO – prior to his hiring by Intel – and what measures were being taken to address these concerns. Cadence Design Systems admitted to knowingly exporting restricted electronic design automation tools and semiconductor IP to China's National University of Defense Technology (NUDT) from 2015 to 2021. Tan ran Cadence as CEO from 2008 through 2021, and was executive chairman until May 2023.

What happens now is unclear. Tan joined Intel in March 2025 and has has been cutting costs at the company, including laying off 24,000 workers by the end of the year and putting plans for large new chipmaking "mega-fabs" in Germany and Poland on hold.

With the company's credit rating being slashed to two steps above junk status by Fitch earlier this week, and reports that its 18A process has been hit by low yields and quality issues, putting its manufacturing comeback in doubt, things are looking bad for Intel. Losing its CEO who's only a few months into the job would make things even worse.