The big picture: The PlayStation 5 isn't slowing down – 80 million units sold proves that. But behind Sony's strong numbers is a strategic pivot that could reshape the future of gaming. Executives say they're moving away from a "hardware-centric business model" toward building platforms, communities, and cross-device experiences. If the shift sticks, the PS6 might not just be the next console – it could be the last.

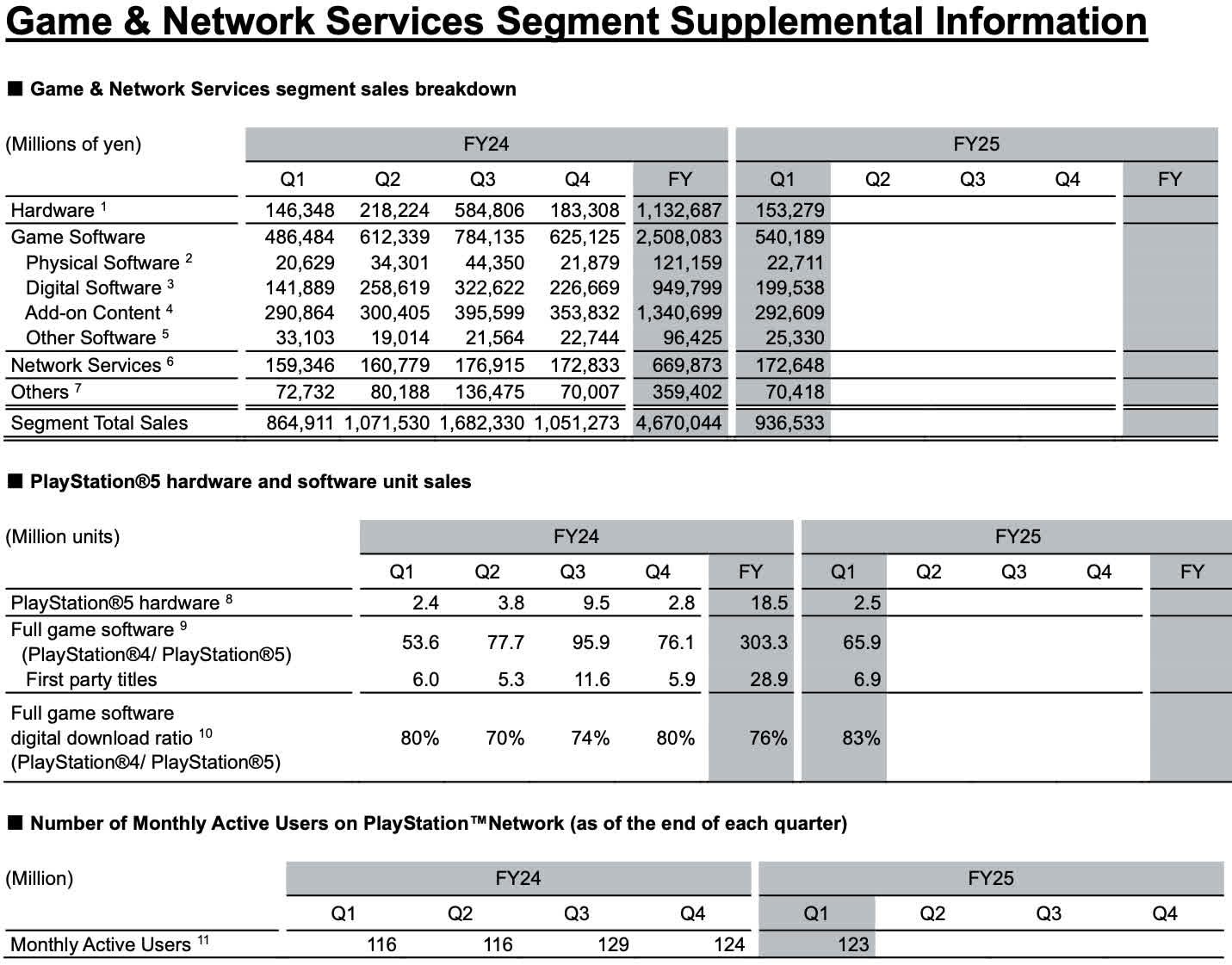

Sony's PlayStation 5 has shipped 80.3 million units worldwide, the company confirmed in its latest financial report. That includes 2.5 million units in its first quarter, slightly ahead of FY2024 Q1. The PS5 matches the sales pace of the PlayStation 4 set during the same stage of its lifecycle. It also remains well ahead of Xbox Series X|S.

Microsoft hasn't released exact hardware numbers, but estimates suggest its console has sold around 30 million units globally since launch – less than half Sony's total.

Software sales hit 65.9 million copies across PlayStation 4 and 5 during the quarter, up more than 12 million year over year. Only 6.9 million were first-party titles, with digital sales dominating. Fully 83 percent of games sold were downloads, marking another step in the platform's shift away from physical units.

PlayStation Network also stayed robust, logging 123 million monthly active users at the end of the quarter. That's a modest dip from the March figure but still above last year's level. Meanwhile, revenue from network services such as PlayStation Plus rose to 172.6 billion yen ($1.19 billion US), while add-on content – like DLC and in-game purchases – generated 292.6 billion yen ($2.02 billion).

Altogether, the Game & Network Services division booked 936.5 billion yen ($6.46 billion) in revenue for the quarter, an 8.3 percent increase from a year ago. Operating income jumped more than 125 percent to 148 billion yen ($1 billion), thanks in part to lower hardware costs and fewer currency headwinds.

Strategically, Sony is signaling that it sees PlayStation's future in ecosystems, not just consoles. In a post-earnings Q&A, Senior Vice President Sadahiko Hayakawa framed the shift as a long-term move toward community and engagement over raw hardware sales.

Sony Senior Vice President Sadahiko Hayakawa says they are gradually shifting their gaming business from a hardware centric business model to a community and engagement based platform business model #PlayStation

– Genki✨ (@Genki_JPN) August 7, 2025

"In the gaming business, we are moving away from a hardware centric... pic.twitter.com/8xnKyihMHE

"In the gaming business, we are moving away from a hardware-centric business model more to a platform business that expands the community and increases engagement," Hayakawa said.

He tied that shift to a broader corporate pivot toward entertainment creation. Games, music, and film now account for 60 percent of Sony's total revenue. Hayakawa said the company is investing more in long-term IP, partnerships, and creation tools – including its stake in Crunchyroll, music publishing, a new entertainment venture with Bandai Namco, and an ongoing effort to bring more PlayStation exclusives to PC. This multi-faceted focus positions Sony to compete not just as a console maker but as a leader in entertainment ecosystems, setting the stage for sustained growth beyond hardware sales.