First look: Pat Gelsinger is once again at the center of US chip policy – this time not as Intel's chief executive, but as executive chairman of xLight, a semiconductor startup now slated to receive up to $150 million in federal support. The Commerce Department has reached a preliminary agreement to inject the capital into the startup in exchange for an equity stake that would likely make the federal government the company's largest shareholder if the deal goes through.

The funding comes from the 2022 Chips and Science Act, specifically from a tranche reserved for early-stage companies developing technologies that could reshape advanced manufacturing.

Gelsinger's new role marks a sharp pivot from his high-profile exit from Intel, which followed a period of weak financial performance and stalled factory expansion. At xLight, he is backing an approach that targets the most challenging part of extreme ultraviolet lithography: the light source that drives patterning at the smallest process nodes.

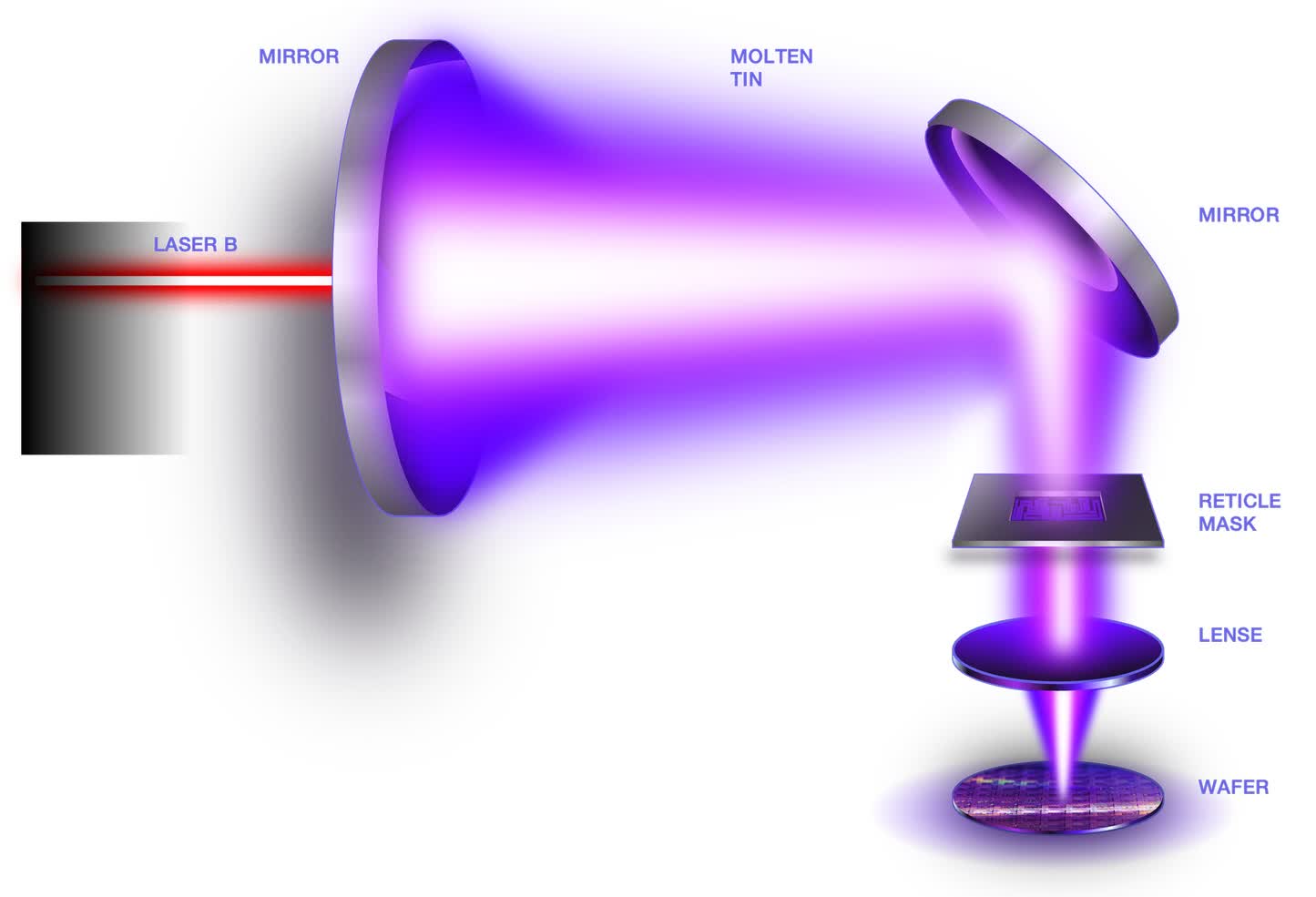

ASML of the Netherlands remains the sole supplier of complete EUV machines, each costing hundreds of millions of dollars, and its current systems generate 13.5-nanometer light pulses inside the tool. xLight is not attempting to replace ASML's platforms; instead, it aims to supply a different class of laser that could be integrated into those machines to push the physics further.

The startup's plan centers on massive free-electron lasers powered by particle accelerators, deployed as utility-scale infrastructure alongside chip fabrication plants. Each installation is designed to span roughly 100 meters by 50 meters and sit outside the fab itself, feeding a more powerful and precisely tuned beam into the lithography process.

xLight says its architecture targets wavelengths as short as 2 nanometers, far below today's 13.5-nanometer sources. If that level of control can be achieved and made reliable in high-volume production, chipmakers could etch denser, finer patterns on chemically treated silicon wafers and extend the miniaturization curve associated with Moore's Law.

Gelsinger has framed the project in both technical and economic terms, arguing that xLight's lasers could boost wafer throughput by roughly 30 percent to 40 percent while consuming far less energy than current EUV light sources.

He has also presented the work as a personal continuation of his decades-long involvement in semiconductor manufacturing. "I wasn't done yet," he told The Wall Street Journal, describing the effort as "deeply personal" given his history designing microprocessors and running large-scale fabs. He says the company's goal is to ship its first wafers produced with the new light sources by 2028, using Chips Act funds to help bridge the capital-intensive development phase.

The government's approach to the xLight deal echoes its more controversial moves with larger chipmakers but with some notable differences. Critics of the broader strategy have labeled Washington's direct investments in individual firms as state-directed industrial policy that risks locking in specific winners.

In this case, Commerce Secretary Howard Lutnick has described the planned stake in xLight as support for a technology that could "fundamentally rewrite the limits of chipmaking," rather than just another subsidy for capacity. The preliminary agreement still needs to be finalized and could change, but it signals a willingness to invest public money in more speculative, physics-heavy projects instead of focusing solely on plant construction.

xLight itself remains an early-stage company. Chief Executive Nicholas Kelez previously worked in quantum computing and government research labs, and the startup raised about $40 million in private capital over the summer from investors including Playground Global, the venture firm where Gelsinger is a general partner.

That funding sits alongside other private efforts to reconfigure advanced chip production in the US. Substrate, a separate semiconductor startup backed by investor Peter Thiel, recently secured $100 million to develop domestic fabs, including its own EUV-related tool concept.

The administration's interest in xLight is part of a broader campaign to bring more of the advanced semiconductor value chain onto US soil. Most state-of-the-art chips are still manufactured in Asia, primarily by TSMC, even as Washington pressures global foundries to expand operations in America.

Gelsinger has said he raised xLight with Lutnick as early as February, before formally joining the startup and prior to Lutnick's confirmation, presenting it as a way to align cutting-edge light-source physics with the policy push to reshore chip production. According to Gelsinger, the pitch seemed to resonate.

"He was very intrigued," Gelsinger said.